Editorial Note: We earn a commission from partner links on Doughroller. Commissions do not affect our authors’ or editors’ opinions or evaluations. Learn more here.

Have you been unable to get a credit card or a loan because of bad or no credit? Credit builder loans are a way to get around that problem. You deposit into a savings account that acts as security for a credit card for the same amount. You use it just like a regular credit card. And when you have a credit balance, you make monthly payments. Those payments are reported to the credit bureaus, helping you build or elevate your credit.

But what if you don’t have the money to deposit into a savings account to create the credit builder? That’s where Self (formerly Self Lender) comes into the picture. They’re a different kind of credit builder program. Instead of making a security deposit, they set up a loan program in which the payments go into a certificate of deposit.

Not only do you build or bump your credit rating, but you’ll also have a fully funded certificate of deposit at the end of the program. Our Self review will detail how to sign up for a credit building loan, the costs, and the real expectations for your credit score.

What is Self?

Self helps customers build their credit. The company was founded in 2014 and is based in Austin, Texas. Self has set up and serviced credit builder accounts for almost a decade and boasts of having more than 4.6 million consumers signed up (as of August 2023).

It works very differently from other credit builder-type programs because it doesn’t require you to put up any security deposit. In a real way, it works by setting up a loan that you effectively pay to yourself. After making the payments, the original loan amount is returned to you.

The company is offering its program to consumers in all 50 states. The service is available for individuals looking to build their credit, not those looking to build business credit.

How Self Works

Unlike typical credit builder loans, where you must make a security deposit–usually into a savings account–Self sets you up to fund a certificate of deposit (CD). The CD has a term of 24 months. You can choose the amount of money for the CD from among four different amounts.

The CD is held in your name at one of the four banks below and cannot be withdrawn until the loan is paid in full.

- Lead Bank

- Sunrise Banks, N.A.

- SouthState Bank, N.A.

- First Century Bank, N.A.

You will make monthly payments, gradually building toward the final CD balance. At the end of the loan/CD term, the CD is available for withdrawal (minus interest and fees). In the meantime, all three major credit bureaus receive reports on your payment history.

You will make monthly payments ranging from $25 to $150. The CD will be yours once the loan is paid, minus interest and fees. And hopefully, if you’ve made all of your payments on time, you may see an increase in your credit.

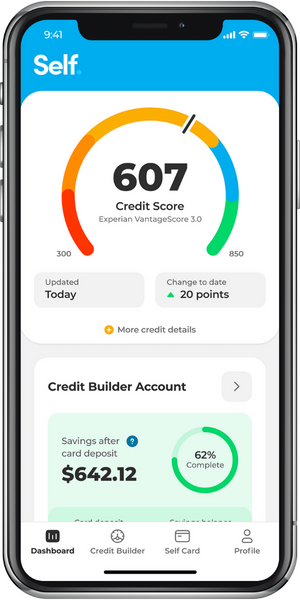

Self Dashboard

Users manage the entire process from the Self dashboard. You can make monthly payments, track your credit history, and even monitor your “Savings Progress”. This is the approximate value of your account if you were to close it out on any given day.

The Savings Progress formula works as follows:

- CD Principal (no interest),

- minus the remaining loan principal,

- minus loan interest accrued to date,

- minus outstanding fees (if applicable),

- minus a CD early withdrawal fee, if terminated early

Of course, this formula is purely theoretical, since you cannot withdraw the funds from the CD early so it simply tracks where you are in the journey.

CD Withdrawal

Once the CD matures, you can pay the funds out minus interest and fees. You typically receive them within 10 to 14 business days after your request.

One major negative with the program is that you cannot temporarily suspend your account. Since it is a credit-builder account, if you cannot make a payment, it will be reported late to the credit bureaus. Late payments are reported if they are more than 30 days past due.

However, the Self credit builder program enables you to accomplish two important goals:

- Build (or elevate) your credit rating with all three credit bureaus

- Build savings in the CD

Self Features and Benefits

Income Requirement

Self does not have an income requirement to open an account.

Credit Eligibility

You will not be denied a credit-builder account if you have either poor or no credit. Eligibility for a Self credit builder account is determined through the ChexSystems database of past retail banking history. Self’s bank partners use ChexSystems to determine your eligibility. This system functions as a credit report monitoring your history of banking relationships.

Credit Score

In general, Self reports that establishing a FICO score will take at least six months of on-time payments. They also caution that a credit score may drop slightly upon taking the credit builder loan if you already have a credit score since it will represent a new and unproven obligation.

Self reports customers with a good-standing credit-builder account have experienced an average credit score increase of 49 points within the first 12 months. They also report subprime customers experience a credit score increase of 20 to 25 points over the life of the loan.

Your credit score will be available on the Self dashboard.

Making Monthly Payments

You link your bank account to your Self account, and you can either make one-time payments each month or set up automatic payments.

Account Beneficiary

When you open a credit-builder account with Self, you can designate a beneficiary for any funds paid.

Early Repayment

You are free to pay back your credit builder account at any time. There are no extra fees or penalties for doing so. Once you do, you will receive the proceeds of the CD, plus accrued interest. However, the bank holding the CD will charge an early withdrawal penalty.

Self recommends against early repayment since the primary purpose of the credit builder program is to build or upgrade your credit score. That should happen when the full payment term is complete.

Self Blog and Referral Program

The site offers a blog that deals with credit and personal finance topics, like budgeting, credit cards, debt, financial health, student loans, auto loans, mortgages, and more.

If you refer a friend, you’ll earn $10 when they complete their first successful credit builder account payment.

Why Self Works Better than a Secured Card, Cosigned Loan, or Prepaid Card

Some people who have either bad credit or no credit rely on other types of cards to build credit. One is a secured credit card. This type of arrangement will do the same thing Self will do, reporting monthly payments to all three credit bureaus. In the meantime, you could use the secured card the same way you would a regular credit card.

The disadvantage of a secured card is that you have to fund a savings account as security. If you don’t have the cash, you won’t be able to get the card. And you won’t have access to those funds until either your credit line is paid, or the bank releases the security lien on the account.

The one advantage a secured card has over a Self account is that the card can be used as a credit card. But you’ll also pay interest on that card, and it can be higher than the APR charged on the various Self plans.

Another way to build credit is by getting a loan with a co-signer. This will result in a lower interest rate and better terms. But if you don’t have a cosigner with good credit willing to cosign for you, this obviously won’t work. In addition, if you make any late payments or default on the loan, it will affect your cosigner’s credit, and he or she will then be responsible for paying the remaining balance of the loan. That could ruin an otherwise good friendship or even a family relationship.

Finally, some people with no credit or bad credit try to get by with prepaid cards. While these can function like credit cards, they don’t help to build your credit history. Also, much like secured cards, you can’t spend any more than the amount you add to the card.

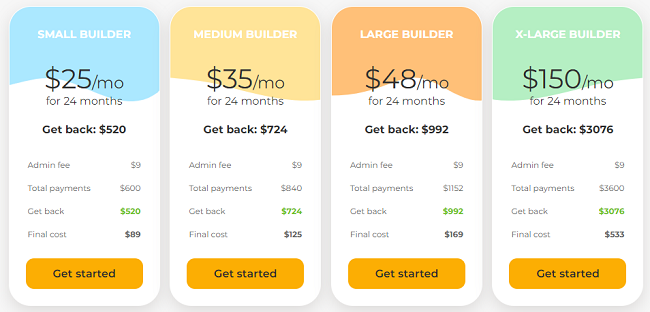

Self Loan Terms and Pricing

When signing up for Self, you’ll have four different loan amounts to choose from. The term is always 24 months (Self previously had a 12-month term, but that has been removed), and the monthly payment ranges from $25 to $150.

You can see from the image above, the total cost to you will go up the higher up the ladder you go. While not guaranteed, you can expect to see a stronger increase in your credit score the larger the loan you take.

- Activation fee: $9

- Late payments: You have a 15-day grace period on monthly payments. After the grace period, the late fee equals 5% of the scheduled monthly payment.

How to Open a Self-Account

The application process takes less than five minutes.

To open an account with Self, you’ll need the following:

- A bank account, debit card, or prepaid card

- Email address

- Phone number

- Social Security number

- Be a valid permanent U.S. resident with a U.S. physical address

- Be at least 18 years of age

Self recommends beginning the process with a linked bank account for monthly electronic payments. If you use a debit card, there will be a convenience fee of $0.30, plus 2.99% of the payment amount, so avoid that at all costs.

Self Pros and Cons

Pros

- Paying on time may increase to your credit

- Allows you a sneaky way to start saving money (by tucking it away into a CD)

- Ability to choose between four different loan amounts

Cons

- Cannot withdraw your money until the loan is paid in full

- You do not get to keep the interest earned on the CD

Self Alternatives

I believe the two products compete very well with the idea of the Self credit-building loan.

The first is the Capital One Platinum Secured Credit Card. This card has no annual fee and an interest rate of . Your credit limit will depend on your security deposit, but you’ll be considered for an unsecured line of credit after six straight months of on-time payments.

If you always pay down your balance and use your secured card responsibly, you’ll likely end up paying less (possibly no fees) than you would using Self. However, there’s a terrible temptation to spend more when using a credit card, so you have to be careful.

The Extra Card is another alternative that works like a secured credit card but is a debit card. Users sign up and connect their bank account and then are given “spending power” based on the amount of money they have available. When you buy something, Extra pays for it and then withdraws the money from your account the next business day.

At the end of the month, the Extra Card will add up all of your purchases and then report those transactions to the three major credit bureaus as credit transactions. Because it’s a debit card, there is no interest rate but an annual fee. And users can also choose to earn rewards for all purchases.

- Credit Building annual fee – $149

- Credit Building + Rewards annual fee – $199

The Extra Debit Card is issued by Evolve Bank & Trust or Patriot Bank N.A. (Member FDIC), pursuant to a license by Mastercard International. Loans provided by Lead Bank. Extra is responsible for credit reporting and reports on time and late payments, which may impact a credit bureau’s determination of your credit score. Rewards points only available with rewards plan.

Should You Sign Up with Self if You Want to Build Credit?

Self is an excellent credit builder plan for someone who doesn’t have enough cash to acquire a secured credit card.

And even though there is an activation fee and an APR, you’ll have ownership of the fully funded CD at the end of the 24-month loan/CD term. Meanwhile, all three major credit bureaus–Experian, TransUnion, and Equifax–receive your payment reports, building or improving your credit score.

In a real way, Self helps you build your credit rating and savings. And since those are two financial situations that often accompany each other, Self will enable you to control both simultaneously.

The major drawback with Self is that once you start the program, you don’t have an option to withdraw–unless you can pay off the loan fully. Otherwise, you’ll need to continue making monthly payments until the plan is complete in 24 months.

Self Credit Builder Loan

Summary

With Self, you can choose which term and amount you want to use to create your loan and it’s low-fee platform will allow you to build your credit without breaking the bank.

Self Disclosure: Sample loans: $25/mo, 24 mos, $9 admin fee, 15.92% APR; $35/mo, 24 mos, $9 admin fee, 15.97% APR; $48/mo, 24 mos, $9 admin fee, 15.72% APR; $150/mo, 24 mos, $9 admin fee, 15.88% APR. See self.inc/pricing

Lead Bank. Member FDIC, Equal Housing Lender Sunrise Banks, N.A. Member FDIC, Equal Housing Lender SouthState Bank, N.A. Member FDIC, Equal Housing Lender First Century Bank, N.A., Member FDIC, Equal Housing Lender The Self Visa® Credit Card is issued by Lead Bank, Member FDIC, Equal Housing Lender or SouthState Bank, N.A., Member FDIC, Equal Housing Lender.